payments & transfers – mobile banking

Send a domestic wire transfer

Wire transfers1 are a quick way to send money domestically or internationally. While you can do both in Mobile Banking2 and Online Banking, this guided demo will focus on wire transfers sent to domestic recipients in Mobile Banking.

For more information, visit our Wire Transfers page.

Need to send a wire transfer? Get started.

Screens simulated for illustrative purposes only. Actual experience may differ.

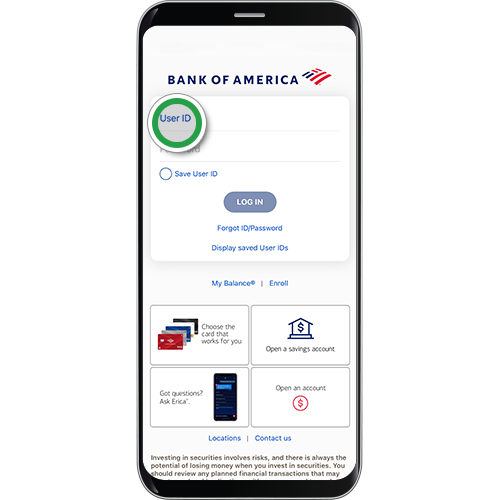

Step 1

Log in to our Mobile Banking app.

Before you get started, first gather the recipient's information:

- Recipient name and address

- Wire routing number

- Bank account number

- Account type

- If you're not enrolled in Secured Transfer, you'll also need your debit card number and PIN.

Need the Mobile Banking app? Start here >

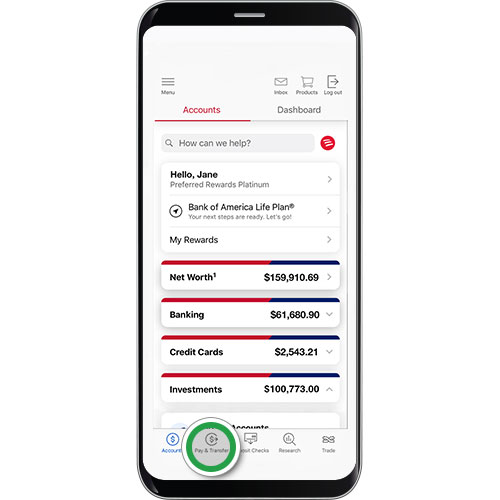

Step 2

Select Pay & Transfer to get started.

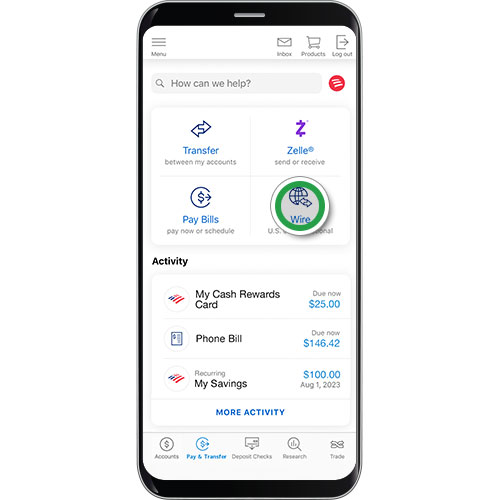

Step 3

Tap Wire.

Step 4

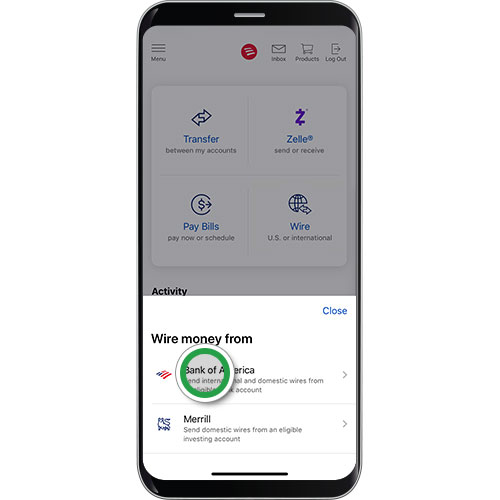

If you have both banking and investing accounts, select the account you want to send the wire from.

Step 5

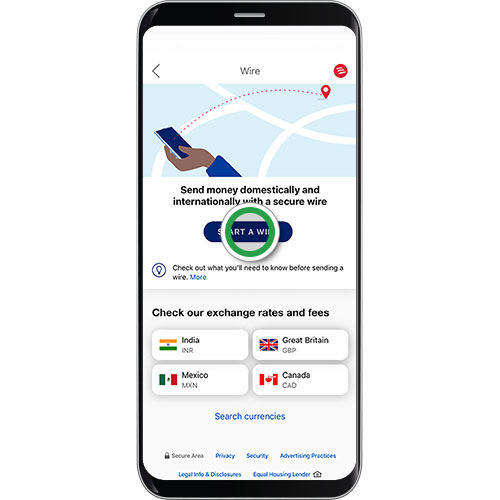

Tap Start a wire to initiate your wire transfer.

Helpful tip! Click More next to the lightbulb to see what you’ll need to send a wire.

Step 6

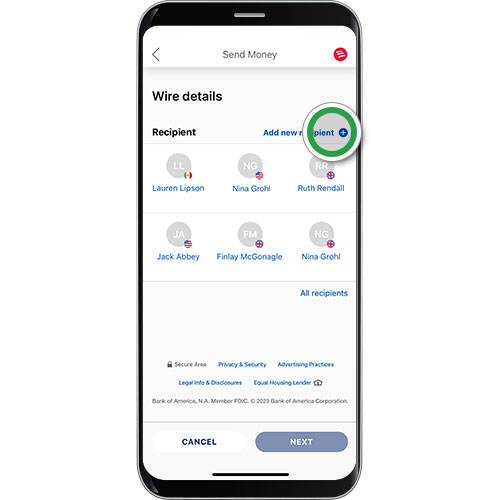

If you're sending money to a recipient for the first time, you'll need to add their account. Tap Add new recipient. If you're sending to an existing recipient, select your recipient. Proceed to step 13.

Step 7

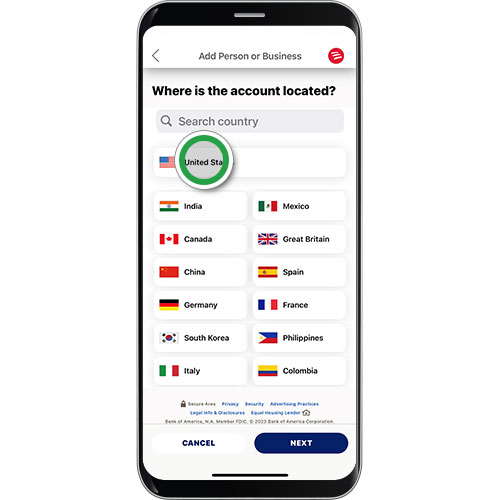

For a domestic recipient, including recipients in U.S. territories, tap United States. Then tap Next. Reminder, this demonstration focuses on Domestic Wire Transfers. For International Wire Transfers, navigate here.

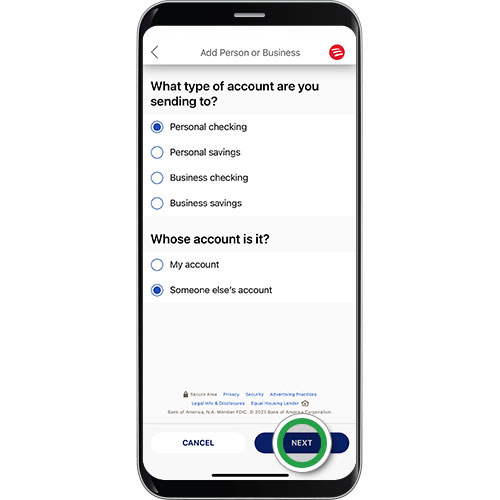

Step 8

Select Recipient account type, then tap Next.

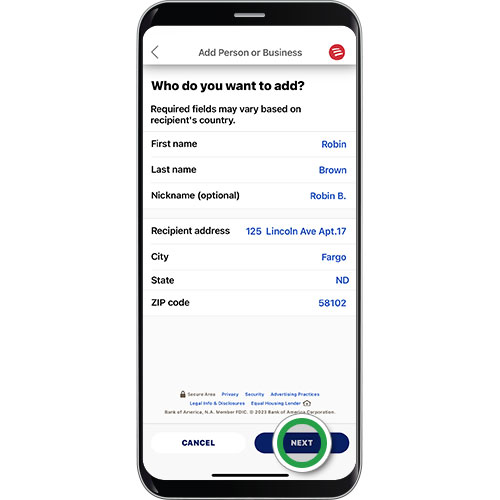

Step 9

Add Recipient’s information. To choose state, select from the menu. Once all details are entered, tap Next.

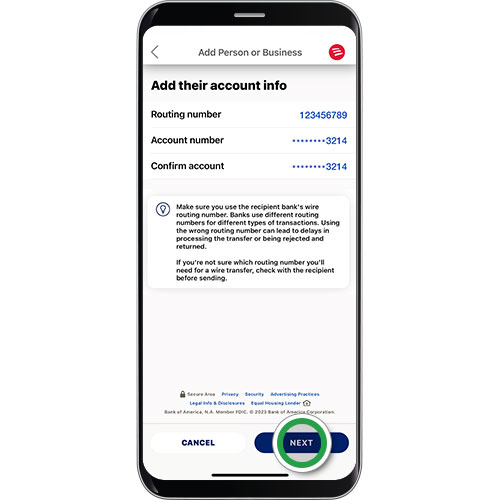

Step 10

Add Recipient’s account details and routing number — be sure to enter the receiving bank’s wire routing number. Tap Next.

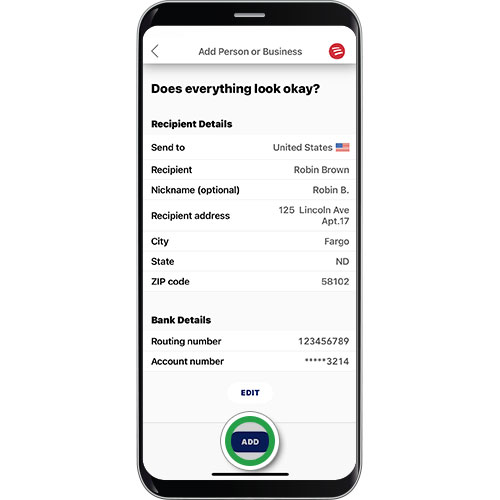

Step 11

Confirm the details for your recipient. Be sure to scroll down to review all details. Tap Add.

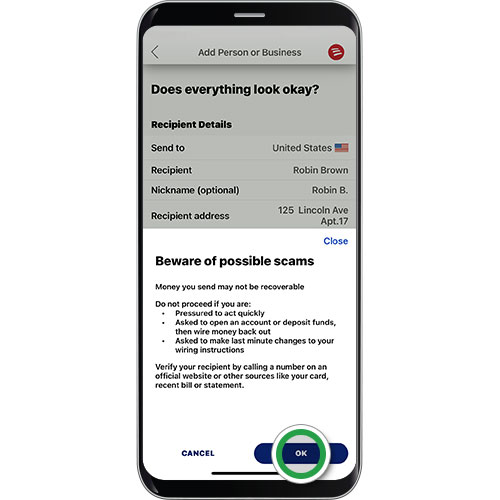

Step 12

Review the important scam reminder and tap OK.

Helpful tip! Always read warning messages. If you’re told to ignore them, it could be a scammer trying to steal your money.

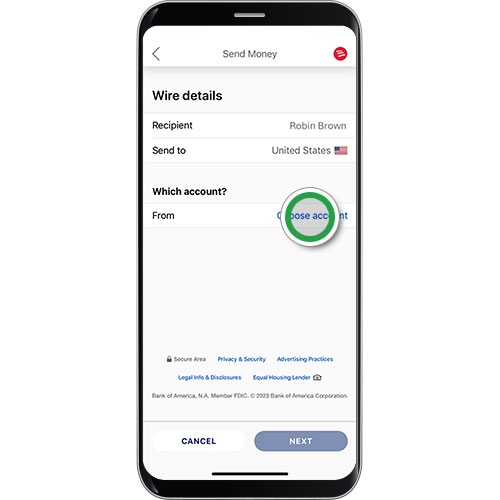

Step 13

Now that your domestic recipient has been added, tap Choose account to select the account from which you want to transfer money.

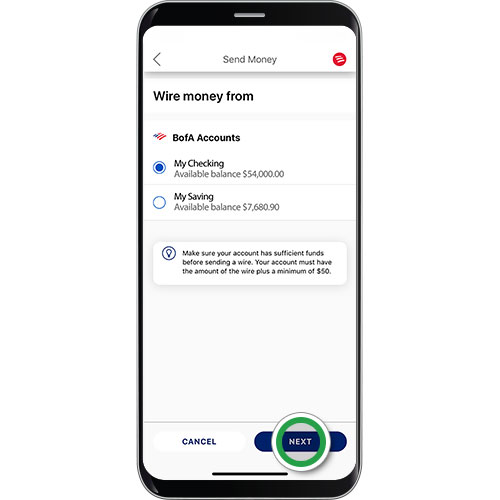

Step 14

Select your "wire from" account for the transfer. Tap Next.

Step 15

Tap enter amount, then enter the amount you want to send. Tap Next.

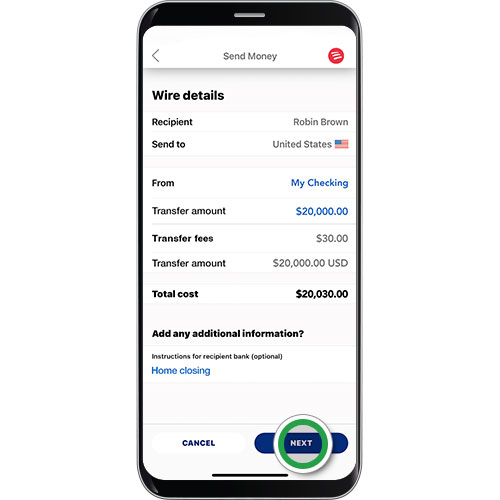

Step 16

Scroll down to review the total cost for the wire transfer, including wire fee. Add optional notes for the recipient’s bank if desired. Tap Next.

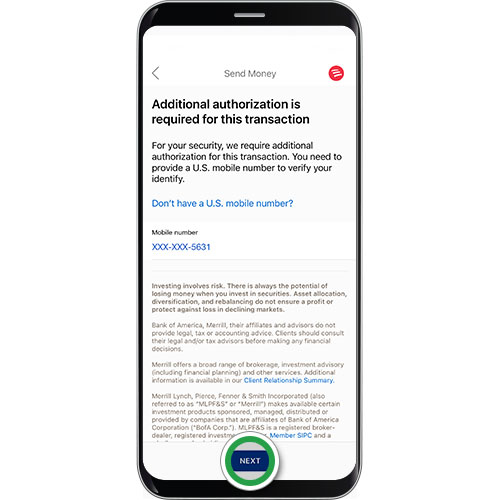

Step 17

If you haven't already, you may be required to enroll in Secured Transfer to send your wire. To get started, add your U.S. mobile number and tap Next.

Note: If you're already enrolled in Secured Transfer, you may be prompted to request an Authorization Code when your transfer exceeds a certain amount.

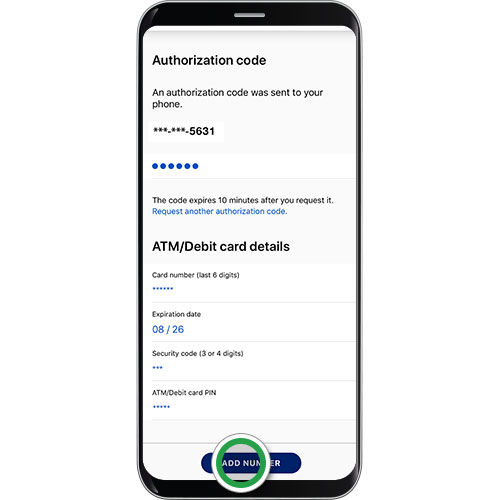

Step 18

You'll receive a text message with an Authorization Code to complete enrollment. Enter your Authorization Code, then add your ATM/debit card details. Tap Add Number to complete the enrollment.

Security Tip! Never share this code with anyone — we'll never call or text you asking for a code.

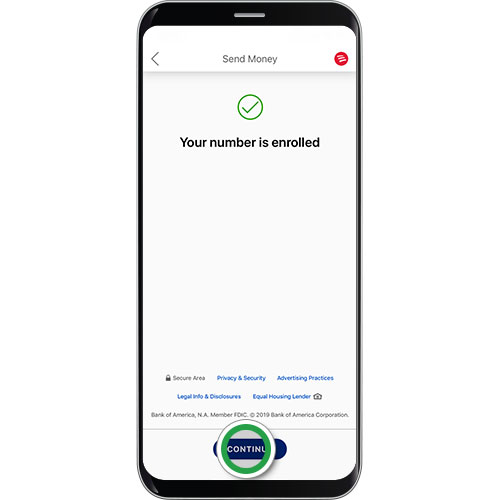

Step 19

You will receive confirmation that your mobile number is enrolled. Tap Continue to proceed with your domestic wire transfer.

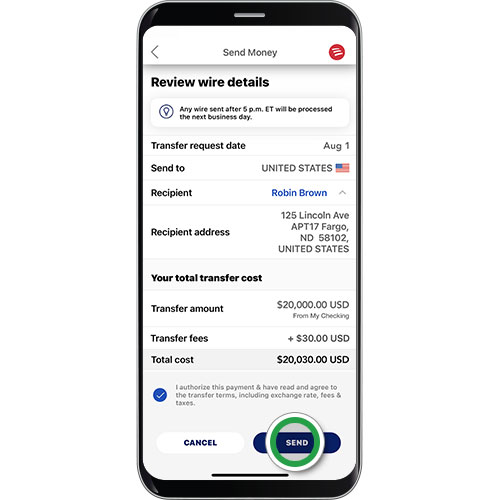

Step 20

Before sending the wire transfer, review the wire details. Be sure to expand the fields and scroll down the screen to confirm all details. Tap Edit at the bottom of the screen if you need to modify any details. After you've confirmed all details are correct, tap the circle to authorize the payment. Then tap Send to submit the wire transfer.

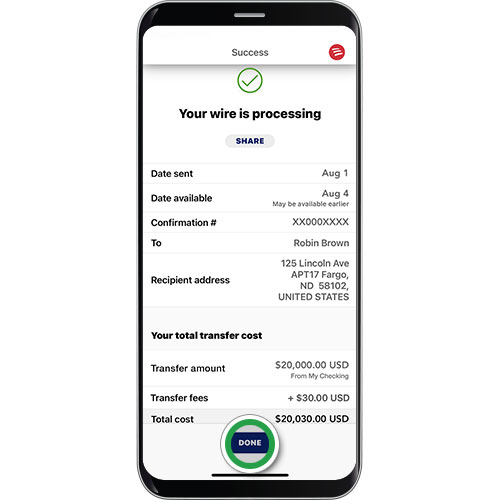

Step 21

You'll see a confirmation that your Wire Transfer has been submitted. Tap Share to save and share a receipt. Tap Done to exit the Wires screen. You'll receive email confirmation.

Note: Domestic wire transfers are typically received the same business day if sent before 5 p.m. ET.

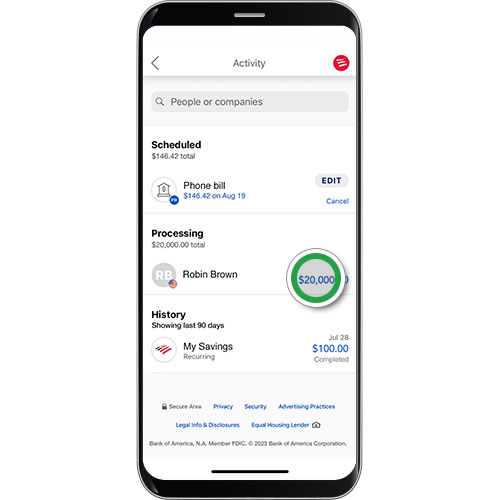

Step 22

Your wire transfer will appear in the Activity screen where you can view status and details.