MAP7595866-10012026

Mobile and Online Banking

Secure access to your accounts to help you stay in control of your financial life, 24/7.

Need the Mobile app?1 Get started

Online Banking

Convenient tools and features that help put you in control of your finances from your computer.

ATM or meet with a specialist

Find an ATM, open an account online or schedule an appointment.

Get answers.

Erica,2 your virtual financial assistant, is here to help with:

- Your servicing needs

- Providing answers to your financial questions

- Connecting you to financial specialists when you need it

- And much more

Deposit money

Take advantage of convenient ways to deposit your money.3

- Mobile Check Deposit4 — Deposit checks from almost anywhere with the Bank of America Mobile Banking app.

- Direct Deposit — Set up direct deposit to have your money automatically sent to your account.

- ATM — Conveniently deposit cash and checks at select ATMs.

Direct Deposit is not available on SafeBalance® for Family Banking accounts.

Pay and transfer

With Bank of America, you have convenient ways to move money and make payments.3

- Zelle® — Send and receive money with friends and family in minutes.5 Money is sent directly between accounts with no fees in our app or Online Banking.

- Pay bills — Easily manage and pay your bills. Get reminders when bills are due and set up one-time or recurring payments on the date you specify.

- How to transfer money6 — Move money from one account to another with just a few taps.

- Wires — Send domestic and international wires,7 plus get a competitive exchange rate8 on international transfers in the Mobile app or Online Banking.

- ATM — Make a Bank of America payment at an ATM.

Zelle® is not available on SafeBalance® for Family Banking accounts.

Account management

Monitor account activity, see your statements, enable security features and more.

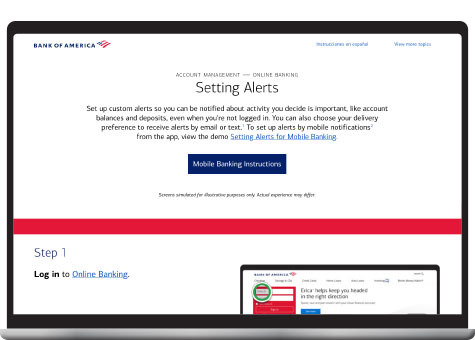

- Alerts9 — Turn on alerts to help you stay connected to your account.

- Paperless10 — Go paperless to reduce the risk of lost, delayed or stolen mail.

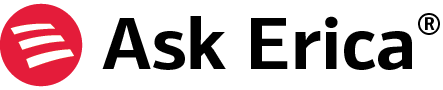

- Security — Check your account security level, enable more security features, and see scam red flags.

- Order Checks11 — Request deposit slips or review the status of an order.

Card management

Easy access to help you manage your Bank of America debit and credit card and more.

- Debit card — Explore ways to use your debit card. It's fast, easy and secure with our $0 Liability Guarantee12

- Credit card — Access frequently used credit card features and services

Additionally, check out the convenience of Digital Wallets and cash-back deals.13

Resource Center

Security Center

Learn red flags of trending scams and how you can help to prevent fraud and identity theft.

Financial Wellness Tools

Build your financial foundation with personalized support, easy to use digital tools and solutions.

How-to Guide for Digital Banking

Explore digital features on your time, and at your pace.

Mobile and Online Banking allows you to securely access your Bank of America checking, savings, credit/lending accounts and Merrill investing accounts, 24 hours a day 7 days a week with a computer or with our Mobile Banking app. With either Mobile or Online Banking you can set up security and other alerts for your account, make transfers, pay bills and more.

Mobile Banking requires that you download the Mobile Banking App and is only available for select mobile devices. Message and data rates may apply.

Enrolling in Mobile and Online Banking is easy and takes just a few minutes. You can enroll in either Mobile Banking or Online Banking, and your User ID and password are the same.

Visit our Guided Demos to see how to enroll:

Mobile and Online Banking uses industry-standard protocols that leverage encryption for transferring data. Encryption creates a secure environment for the information being transferred between your browser and Bank of America. These security protocols protect data in 3 key ways:

- Authentication helps ensures that you are communicating with the correct server. This prevents another computer from impersonating Bank of America.

- Encryption helps scrambles transferred data to prevent eavesdropping of sensitive information and to ensure that only the server you're sending the information to can read it.

- Data integrity helps verify that the information sent by you to Bank of America wasn't altered during the transfer. The system detects if data was added or deleted after you sent the message. If any tampering has occurred, the connection is dropped.

There is no fee to access Mobile and Online Banking. However, certain accounts, transactions or services within the Mobile app/Online Banking may incur fees.

Mobile Banking allows you to access your account information from almost anywhere using the Mobile app on your wireless device. Online Banking requires you to access your account through your web browser.

Most features are available in both Online Banking and the Mobile app, however there are some exceptions, for example Erica and Mobile Check Deposit which are available only in the Mobile app.

Mobile and Online Banking gives you secure access to your accounts and includes features that help you manage and monitor your accounts, including but not limited to:

- Bank 24/7 without having to visit a center – make deposits, transfer money and more

- Custom alerts help you manage and monitor your accounts

- Security meter shows your account security level with actions you can take to help improve your security.

- Set up a budget and track spending

If you forget your Mobile/Online Banking password you can reset it: Create a new password

Learn more about how to Troubleshoot your ID/Password.

Yes, your statements with check images are available online: You can view, print and download up to 18 months of your statements at any time. When you go paperless with our online statements service, we provide check images as part of your statement, and you receive your statements online.

If you're an Online Banking customer, you can go paperless now. In most cases, your paperless settings will take effect after your next document cycle.

Not an Online Banking customer? Enroll in Online Banking today

To view your statements online in PDF format, we recommend using Adobe Reader version 6.0 or higher (download Adobe Reader layer). If you’re having trouble downloading your statements, we recommend trying a different browser (view our list of supported browsers).

Credit card, checking and savings statements become available in Mobile and Online Banking on approximately the same date each month, depending on your statement closing date, though may vary by a day or two because of how many days are in a month (for example 28 in February vs. 31 in March) or U.S. bank holidays. Automobile and recreational vehicle loan statements become available 20 days prior to your payment due date.

The availability of mortgage and home equity statements can vary. For more information, please contact customer service.

If you're an Online Banking customer, you can go paperless now. In most cases, your paperless settings will take effect after your next document cycle.

Not an Online Banking customer? Enroll in Online Banking today

For eligible accounts, Bank of America makes it possible for you to stop (or resume) receiving paper statements in the mail. Paperless statements allow you to avoid messy filing and conserve our natural resources. When you receive paperless statements, you get all the same information that you get today in your paper statements (promotional materials will not be included).

To change your paper statement delivery preferences, sign into Online Banking, select Profile & Settings then Paperless settings. If you choose to stop delivery of paper statements, we’ll send you an email every month reminding you that your statement is available for viewing online. You can always resume delivery of your paper statements at a later date by going to Profile & Settings within Online Banking and selecting the Paperless settings link.

There is no fee to go paperless. If you're an Online Banking customer, you can go paperless now. In most cases, your paperless settings will take effect after your next document cycle.

Not an Online Banking customer? Enroll in Online Banking today

There are many advantages to stopping mail delivery of your paper statements:

- You may be able to help reduce your threat of mail fraud or identity theft.

- You receive exactly the same information in an online version of your statement through Online Banking as you would with a paper version.

- You get an email each month notifying you that your statement is available for viewing and printing online.

- You receive your online statements several days before you receive your paper statements.

- You can order copies of statements beyond what is available online (we keep copies of your statements for 7 years)

- You can resume paper mail delivery of your statements at any time.

If you're an Online Banking customer, you can go paperless now. In most cases, your paperless settings will take effect after your next document cycle.

Not an Online Banking customer? Enroll in Online Banking today

To make balancing your account easier, we have a step-by-step worksheet available to you. The printable worksheet allows you to enter recent transaction activity and compare your account balance with the current statement. Download the Balance Your Account worksheet (PDF, requires download Adobe Reader layer)

You can order copies of your statements beyond what is available online, up to 7 years ago. Your statement copy will be delivered online, free of charge.

If you are an Online Banking customer, you can sign into Online Banking, and select Statements & Documents under the Accounts tab. Then select the Request statements tab. Electronic statements are available 24-36 hours after your request, and are accessible for 7 days. You'll receive an email with a link to your statements when they're available.

Not an Online Banking customer? Enroll in Online Banking today

You can order a paper statement copy beyond what is available online. We keep copies of your statements for 7 years. If you are an Online Banking customer, you can sign into Online Banking, and select Statements & Documents under the Accounts tab, then go to the Request statements tab and select Order a paper statement copy. Paper statements will be mailed 7 to 10 business days after you submit your request.

Not an Online Banking customer? Enroll in Online Banking today

We keep copies of your statements for up to 7 years.

If you're an Online Banking customer, you can go paperless now. In most cases, your paperless settings will take effect after your next document cycle.

Not an Online Banking customer? Enroll in Online Banking today

Your check images are available online for viewing up to 18 months. If you are an Online Banking customer, you can sign into Online Banking and select your account from the Accounts tab. You can then select a check for viewing from the Activity tab.

If you're an Online Banking customer, you can go paperless now. In most cases, your paperless settings will take effect after your next document cycle.

Not an Online Banking customer? Enroll in Online Banking today

When you go paperless with our online statements service, we provide check images as part of your statement, and you receive your statements online.

If you're an Online Banking customer, you can go paperless now. In most cases, your paperless settings will take effect after your next document cycle.

Not an Online Banking customer? Enroll in Online Banking today

If you are an Online Banking customer, you can order check copies now or sign into Online Banking and select your account, then select the Information & Services tab.

Not an Online Banking customer? Enroll in Online Banking today to download and print your checks or contact us for assistance with your check copy request.

For copies of checks more than 18 months old, you will need the check number, date and amount for each check ordered.

For check copies from your line of credit account, please call us at 800.934.5626.

In most states, if you have a combined statement, the check images are available only for your primary checking account. All canceled checks for other accounts will be held by us, according to the Check Safekeeping Service as described in your account agreement.

Your check images are available online for viewing up to 18 months. If you are an Online Banking customer, you can sign into Online Banking and select your account from the Accounts tab. You can then select a check for viewing from the Activity tab.

The bank retains check images for up to 7 years from the date they are posted to your account.

The IRS, Federal Reserve, local and state governments, courts of law and merchants generally accept check images as valid proof of payment.

The Check Clearing for the 21st Century Act (Check 21) is a federal law allowing banks that process checks to convert them to substitute checks to make the exchange of funds easier. When an original check is processed and an image of your check is created, the original check is usually destroyed by the processing

bank. This improves the efficiency and safety of the nation’s check payment system. All financial institutions must comply with this federal law, as of October 28, 2004.

No, check images are not available for Braille or large-print statements at this time.

Online Banking customers can order checks and deposit tickets in just a few minutes either on our website or through our Mobile Banking app.

On our website

Log in to Online Banking to order checks or deposit tickets

Not an Online Banking customer? Enroll in Online Banking today

On your mobile device

- Log in to the mobile app

- Navigate to your checking or savings account

- Select Order Checks & Deposit Tickets

Check costs can vary depending on the style of check you choose. Also, Preferred Rewards clients and certain account types qualify for free standard check styles and discounts on non-standard styles.

To view check costs and explore a full catalog of checks and related products, log in to Online Banking to order checks or deposit tickets.

For more information about fees and pricing for your account, view the Personal Schedule of Fees.

Yes, you can review the status of your order on our website or on your mobile device.

On our website

Log in to Online Banking to check the status of your recent check order

Not an Online Banking customer? Enroll in Online Banking today

On your mobile device

- Log in to the mobile app

- Navigate to your checking or savings account

- Select Order Checks & Deposit Tickets. Your recent order (as long as it’s been made within the last 60 days) will display at the top of the page.