Send wire transfers in Online Banking or our Mobile Banking app1

Send domestic and international wire transfers in 140+ currencies to over 200 countries.2 Available in English and Spanish.

Explore wire transfer FAQs

| Wire type | Fee |

|---|---|

| Domestic | $30 |

| International, U.S. Dollars | $45 |

| International, foreign currency | No wire transfer fee* |

*International, foreign currency: No wire transfer fee, but exchange rate markups apply.2

Select Preferred Rewards members could save on wire transfer fees.

Sending wire transfers

To send a wire transfer, log in to our Mobile app or Online Banking and tap Pay & Transfer. You will need your debit card number, PIN and U.S. mobile number OR a USB security key.

Domestic:

- You need the recipient's name, address, bank wire routing number (ABA) and account number.

- Cutoff time is 5 p.m. Eastern, and funds typically arrive the same day (business days only).

International:

- You need the recipient's name, address, bank information, such as SWIFT code, and account number.

- Some countries require specific bank identifiers (e.g., Canada's Transit Code or India's IFSC code), account identifiers (e.g., IBAN, or CLABE for Mexico), and/or recipient details. See the Foreign Currency Payments Guide for details.

- You can send in U.S. Dollars or foreign currency; cutoff time is 5 p.m. Eastern, and funds typically arrive in 1 to 5 business days, but this may depend on currency selected and processing time of the receiving bank.

- To see the detailed status of a wire transfer, log in to the Mobile app or Online Banking, select Pay & Transfer, then select the transaction.

Fees and limits may apply.

Receiving wire transfers

To receive domestic and international wire transfers, you will need to provide the sender your account information and the following information. To find your account number, log in to our Mobile app or Online Banking and select your receiving account.

Domestic (U.S.):

- Bank of America’s wires routing number: 026009593

International:

- Receive in U.S. Dollars: SWIFT Code BOFAUS3N

Bank of America N.A.

222 Broadway, New York, NY 10038 - Receive in foreign currency: SWIFT Code BOFAUS6S

Bank of America N.A.

555 California St., San Francisco, CA 94104

Domestic transfers will typically be credited to your account the same business day, and international transfers will typically be credited to your account in 1 to 2 business days.

Inbound wire transfers may incur a $15 fee per wire. See the schedule of fees for details: Personal or Business.

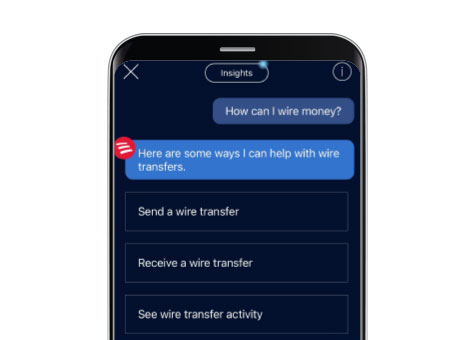

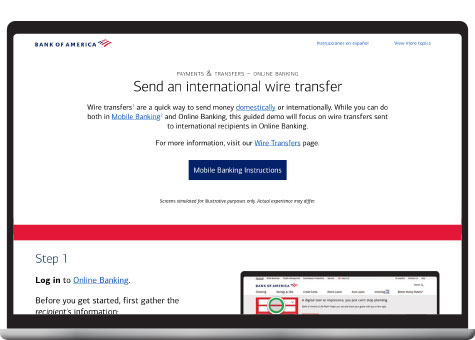

See how to do a wire transfer

Review digital demos to see how to set up domestic and international wire transfers with the Mobile Banking app or Online Banking.

Resource Center

Security Center

Learn red flags of trending scams and how you can help to prevent fraud and identity theft.

How-to Guide for Digital Banking

Explore digital features on your time, and at your pace.

A wire transfer is a fast way to send money electronically to a domestic (U.S.) or an international recipient’s bank account.

This is an international wire transfer initiated by a consumer for personal, family, or household purposes.

Log in to Bank of America’s Mobile Banking app or Online Banking and tap “Pay & Transfer” to send a Domestic or International wire. If you choose to enroll in secure transfer, you will need your debit card number, PIN, and a U.S. mobile number or a USB security key.

Domestic

- You need the recipient’s name, address, bank wire routing number (ABA) and account number.

- Cut off time is 5 p.m. Eastern.

International

- You need the recipient’s name, address and bank information, including SWIFT code and account number.

- You can send in U.S. dollars or foreign currency; cutoff time is 5 p.m. Eastern

- Some countries require specific bank identifiers (e.g. Canada’s Transit Code or India’s IFSC code), or account identifiers (e.g. IBAN, or CLABE for Mexico). See the Foreign Currency Payments Guide for details

You can also make an appointment to send a wire transfer at a local Bank of America financial center.

When deciding between sending in a foreign currency or U.S. dollars, you should consider factors that impact the total cost to send and the amount available after the transfer, such as exchange rates and fees.

Show me how to set up a domestic wire transfer

Show me how to set up an international wire transfer

For Remittance Transfers, we're required by law to inform you of the exact fees that we and/or our agent banks will impose to deliver an international wire. For some requests, we won't have the exact fees our agent banks and therefore will not be able to process it. If your request was in US dollars, you may try again in foreign currency — this may help us determine the exact fees incurred for this transaction and enable us to send the wire request successfully.

Yes, international wires should be sent in USD to the following countries and territories: Colombia, Nigeria, Panama, Somalia, Timor-Leste, Venezuela, and the Palestinian Territories.

Contact us at 877-337-8357 (or 302-781-6374 from outside of the U.S.).

You can also write to us at:

Bank of America, N.A.

PO Box 25118

Tampa, FL 33622-5118

For international wires initiated by a consumer primarily for personal, family or household purposes, you must contact us within 180 days of the date we indicated to you that funds would be made available to the recipient. Please have the following information handy:

- Your name and address (or telephone number)

- The problem with the transfer, and why you believe it's an error

- The name of the person receiving the funds, and if you know it, his or her telephone number or address

- The dollar amount of the transfer

- The confirmation code (provided from the Transfer Receipt)

We'll determine whether an error occurred within 90 days after you contact us and we'll correct any error promptly. We'll tell you the results within 3 business days after completing our investigation. If we decide that there was no error, we'll send you a written explanation. You may ask for copies of any documents we used in our investigation.

Please note that in the event you provide an incorrect account number or institutional identifying number, and we are not able to recover the funds, you may lose the amount of the payment order.

International wire transfers initiated by a consumer primarily for personal, family, or household purposes may be cancelled within 30 minutes of submission for a full refund, including any fees.

To cancel a Mobile Banking or Online Banking Remittance Transfer, complete the following steps:

- Log in to the Mobile Banking app or Online Banking

- Select “Pay & Transfer”

- Under “Activity”, locate the transaction, and select “cancel”

- Review the cancellation notification and select “cancel” to complete request

You can also visit your local Bank of America financial center or call us at 877-337-8357. From outside of the U.S., call us collect at 302-781-6374.

If you initiated the Remittance Transfer at a Bank of America financial center, you can get the transfer canceled by going to the nearest banking center or by calling us at 877-337-8357 (or 302-781-6374 from outside the U.S.).

Domestic Wires

Your sender will need your Bank of America account number and wire routing number.

To find this information in the Mobile Banking app, complete the following steps:

- Log in to Bank of America's Mobile Banking app.

- Navigate to Accounts.

- Select the account you wish to receive the funds with.

- Select Account & Routing # to display account details.

To find this information in Online Banking, complete the following steps:

- Log in to Bank of America's Online Banking.

- Navigate to the Accounts page.

- Select the account you wish to receive the funds with.

- Navigate to the Information & Services tab.

- Click Show full account number in the Account Information section.

International Wires

In addition to your account information and other personal details, your sender may need the Bank of America SWIFT code and address as follows:

Wires sent in U.S. dollars or unknown currency:

Swift Code: BOFAUS3N

Address: Bank of America, N.A.

222 Broadway, New York, NY 10038

Wires sent in Foreign currency:

SWIFT Code: BOFAUS6S

Address: Bank of America, N.A.

555 California St. San Francisco, CA 94104

Fees

See the Personal Schedule of Fees and for details on incoming wire transfer fees.

Bank of America fees and limits may apply, depending on your account type and the type of wire. Review the Online Banking service agreement for information on fees and limits.

For international wire transfers, other fees or amounts may also apply, including those charged by recipient’s financial institution, foreign taxes, and other fees that are part of the wire transfer process. For wires sent in foreign currency, markups associated with the currency conversion are included in the Bank of America, N.A. exchange rate and we make money from the foreign currency exchange. These rates are determined by Bank of America in its sole discretion. When deciding between sending in foreign currency or U.S. Dollars, you should consider factors that impact the total cost to send and the amount available after transfer, such as exchange rates and fees.

For Remittance Transfers, we're required by law to inform you of the exact fees we and/or our agent banks will impose to deliver an international wire. For some requests, we won't have the exact fees from our agent banks and therefore will not be able to process it. If your request was in US dollars, you may try again in foreign currency — this may help us determine the exact fees incurred for this transaction and enable us to send the wire request successfully.

For transfers over specific dollar limits set by your account type, you will need to register for either Secured Transfer or a USB Security Key. You’ll be prompted to register an additional security feature at the time of transfer. Follow the prompts for more details or review Additional Security Feature FAQs for more information.

A SWIFT code is a standard format for Business Identifier Codes (BIC). It’s used to identify banks and financial institutions globally, and they're used when transferring money between banks.

IBAN (International Bank Account Number) is used to identify an individual bank account in cross-border payments in many countries around the world. If you don't know the IBAN Number, check with your recipient. The IBAN is comprised of a maximum of 27 alphanumeric characters within Europe and a maximum of 34 outside of Europe (for example, German IBAN: 22 characters). When sending wire transfers to countries that have IBAN numbers, we recommend using the IBAN in your wire transfer to identify the bank and the account of the recipient.

The United States does not currently participate in IBAN. Therefore, Bank of America accounts do not have IBAN numbers.

If you are transferring funds to an international account, we will begin processing the transfer, and your account will be debited, on the business day you direct us to initiate the transfer. The funds typically arrive in 1-5 business days; however, there are a number of factors which could delay the wire transfer, such as: currency selected, processing time of the receiving bank, local bank holidays, and delays by an intermediary bank or other local conditions.

MAP7595866-10012026