MAP7595866-10012026

Direct Deposit — Access your money faster

Skip extra trips to the bank. Set up direct deposit and have your paycheck or other recurring deposits sent right to your eligible checking or savings account — automatically. Explore our Direct Deposit FAQs

Convenient and easy access to your money

- Get same-day access to your deposit from almost anywhere

- Reduce the risk of lost or stolen paper checks

- Set-up Alerts1 in Online Banking or in the Mobile app2 to know when your money is deposited.

Log in to Online Banking and

download a prefilled direct deposit form

On your mobile device?

Ask Erica® to help download a prefilled direct deposit form

Not using Online Banking?

Enroll now

Setting up direct deposit

What do I need to do?

Check with your employer’s payroll office. You may be able to complete setup through an online portal. If not:

- Complete a direct deposit form.

- Provide the form to your employer’s payroll office.

Log in to Online Banking and download a prefilled direct deposit form

You’ll need to know:

- Your Bank of America account and ABA routing numbers

- Your employer’s name and address

- Direct Deposit is not available for SafeBalance Banking® for Family Banking accounts.

For checks issued by the U.S. Treasury

Enroll in direct deposit of federal benefits in one of 3 ways:

- Online at www.godirect.gov/gpw/

- Call the U.S. Treasury

at 800-333-1795 - Schedule an appointment at your nearest financial center

Resource Center

Security Center

Learn red flags of trending scams and how you can help to prevent fraud and identity theft.

How-to Guide for Digital Banking

Explore digital features on your time, and at your pace.

Qualifying direct deposits are deposits of regular monthly income (such as your salary, pension, or Social Security benefits) that are made by your employer or other payer using the account and routing numbers that you provide to them. These deposits qualify for Bank of America Advantage Plus Banking® and Senior Economy Checking monthly maintenance fee waiver.

Teller deposits, wire transfers, Online and Mobile Banking transfers, transfers from one account to another, and ATM transfers and deposits are examples of deposits that do not qualify for the monthly maintenance fee waivers.

Learn more about direct deposit and download a form to set it up with your employer.

Setting up direct deposit is easy. Check with your employer's payroll office, you may be able to set up your direct deposit through an online portal. If not:

- Complete a direct deposit form.

- Provide the form to your employer's payroll office.

Log in to Online Banking to download a prefilled direct deposit form

Not using Online Banking?

Enroll Now

In order to complete the direct deposit form, you'll need to know:

- Your Bank of America account and ABA routing numbers

- Your employer's name and address

Locate your account and routing number

Looking for just your routing number? Use our routing number selector

There is no charge for direct deposits.

Log in to Online Banking to download a prefilled direct deposit form

Not an Online Banking customer? Enroll in Online Banking today

You can set alerts for important account activity using Online Banking or the mobile app.

Want us to walk you through it?

Log in to Online Banking to set up direct deposit alerts

Show me how to set alerts on the mobile app

Not enrolled in Online Banking?

Enroll in Online Banking

Get the app

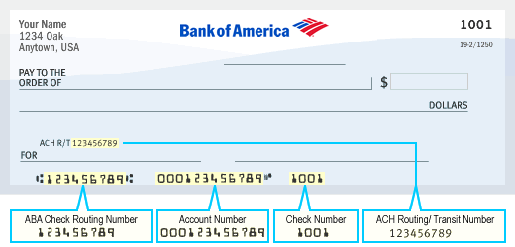

If you're reordering checks, seting up a direct deposit or an automatic payment or preparing a wire transfer, you'll probably be asked to provide an ABA routing number.

This sample check image shows where the ABA routing number and checking account number can be found on your checks. (Refer to your own check for your specific numbers.)

There are 3 ways to enroll in direct deposit of federal benefits:

- Visit the U.S. Dept of the Treasury website.

- Call the U.S. Dept. of the Treasury at 800-333-1795.

- Schedule an appointment at your nearest financial center and we'll be happy to assist you.

Please visit the Social Security website for guidance on how to set up or change direct deposit.