MAP7595866-10012026

Deposit checks easily with Mobile Check Deposit

Deposit checks from almost anywhere with the Mobile Banking app1 and get immediate confirmation that your deposit is processing.2

Explore Mobile Check Deposit FAQs

Need the Mobile app? Get started

Skip the trip

Deposit checks on your schedule without visiting the bank or ATM.

Know instantly

Receive immediate confirmation that your deposit is processing.

Use these four easy steps to deposit checks

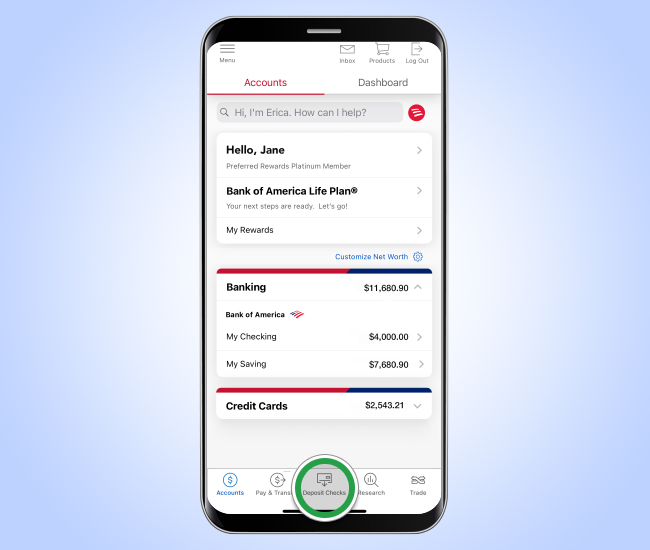

Step 1

Log in to the Mobile Banking app and select Deposit Checks.

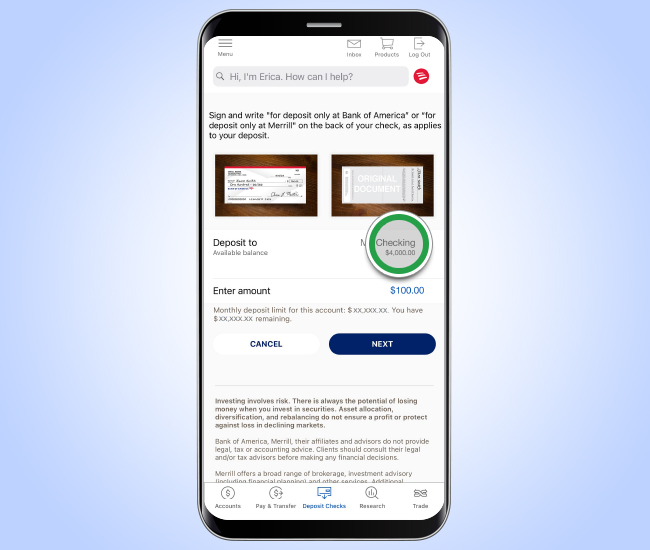

Step 2

Take a picture of the front and back of your endorsed check.

Step 3

Select the account to receive the deposit and enter the amount.

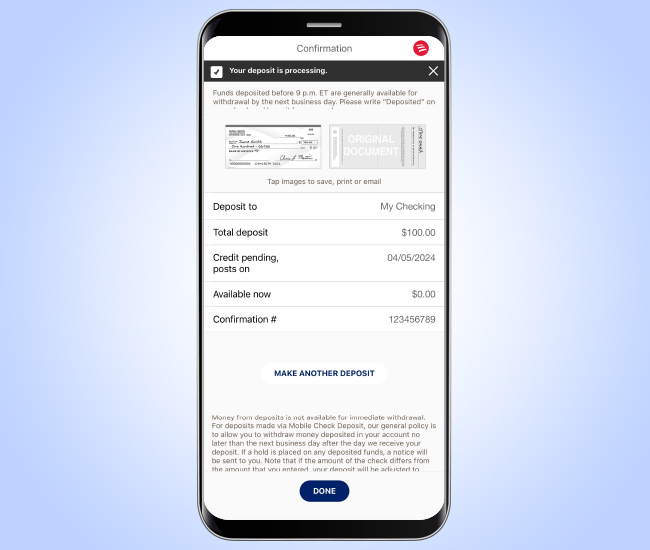

Step 4

After tapping Submit, you'll receive a confirmation that your deposit is processing.

Need help getting started?

View additional instructions about how to easily deposit checks with the Mobile Banking app.

Resource Center

Security Center

Learn red flags of trending scams and how you can help to prevent fraud and identity theft.

Financial Wellness Tools

Build your financial foundation with personalized support, easy to use digital tools and solutions.

- Open the mobile banking app and select Deposit Checks

- Take a picture of the front and back of your endorsed check

- Select the account to receive the deposit and enter the amount

- Tap Submit and you’ll receive immediate confirmation that your deposit is processing

There is no additional fee for using Mobile Check Deposit, but we recommend that you check with your service provider to see if there are any wireless carrier fees.

We only accept checks from a U.S. financial institution, in U.S. dollars.* The following items are eligible for mobile deposit:

- Personal checks

- Business checks

- Government/treasury checks

- Cashier's checks

Please visit a financial center to deposit the following items which are currently not accepted via mobile deposit:

- U.S. savings bonds

- Checks from foreign banks

- Money orders

- Traveler's checks

- Image Replacement Documents (IRDs)

- Third-party checks

- Checks not payable in U.S. dollars

* Mobile Check Deposit will only accept standard-sized personal or business checks. Oversized or undersized checks (such as rebate checks) may not be accepted via mobile deposit.

Have good lighting and lie the check flat on a dark background

- Ensure all four corners are visible

- Detach the check from any check stub or cover letter

- Hold your device steady directly over the check (not at an angle) to take the picture automatically, or tap the camera icon to take the picture manually

Deposits made to a Bank of America account are not available for immediate withdrawal. Unless a hold is placed, deposits on a business day before cutoff time will be processed that night and are generally available the next business day. To learn more about holds and how to avoid holds, visit the Deposit Holds FAQs.

Deposits made to a Bank of America account on a day that is not a business day (Saturdays, Sundays, and holidays) or after cutoff time on a business day will be processed for deposit on the next business day and generally available on the business day following the process date.

There is a monthly limit for Mobile Check Deposits and it's displayed when you select your deposit account. Once you've hit that limit, you can't deposit another check with the app until the limit is reset at the beginning of the next month.

Once you make a mobile check deposit, you can’t cancel processing. If you’ve made duplicate deposits, we will catch the error and let you know.

Once you've made your deposit, you'll get an email confirmation that we've received your deposit and are processing it. If there is any problem with the transaction, like insufficient funds or potential fraud, you'll receive a leter in the mail asking you to bring the check to a financial center to resolve the issue.