After you enroll, you can move to a higher Preferred Rewards tier — and enjoy more benefits and rewards — by increasing your qualifying Bank of America® deposit and/or Merrill® investment balances. Every month, we'll review your three-month average daily balance and if it’s high enough, you'll receive an automatic tier upgrade. To view your qualifying three-month combined average daily balance, log in to Online Banking or use our mobile app and go to My Rewards.

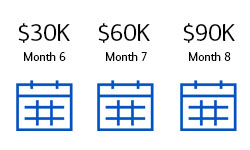

Here's an example:

You’ve been a Preferred Rewards Gold tier member for six months, with an average combined daily balance in your Bank of America and Merrill accounts of $30,000. If your average balance reached $60,000 in month seven and $90,000 in month eight, you’d qualify for the Platinum tier because your three-month average daily balance would be $60,000.*

Three-month total: $180,000

Divided by three months = $60,000 average daily balance

Congratulations! You’ve qualified for the Platinum tier.

*Your tier upgrade may take a bit longer if there are other changes to your account.